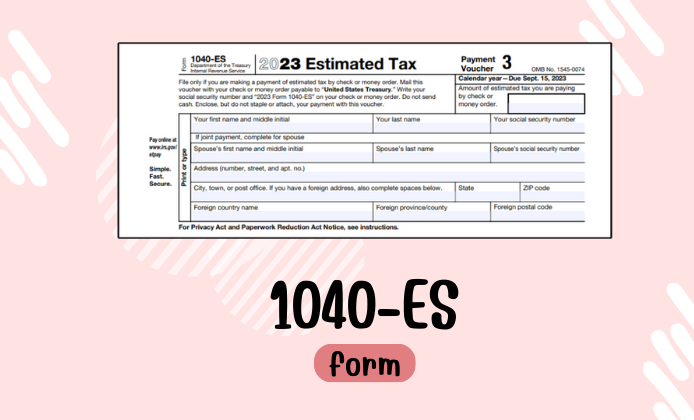

As fiscal season approaches, it is vital for taxpayers to understand the importance of the printable 1040-ES tax form for U.S. taxpayers. This document is instrumental for those who must report and pay estimated quarterly taxes to the Internal Revenue Service (IRS). The printable Form 1040-ES for 2023 is meticulously structured to facilitate taxpayers in accurately calculating and submitting their estimated tax payments.

At the core of Form 1040-ES are sections dedicated to income calculation, estimated tax liability, and payment vouchers. Each section must be filled with precision to avoid miscalculations that could lead to penalties. Specifically, you will find areas on the form where you should report expected income, deductions, credits, and the previous year's tax information. This enables you to determine your estimated tax payments for the current year.

Completing the Printable 1040-ES Form

Ensuring an error-free submission begins with careful completion of the form. Below is a set of guidelines to follow:

- Familiarize yourself with the form and instructions specific to the current tax year.

- Evaluate all sources of income, including self-employment, dividends, and interests.

- Calculate deductions accurately, keeping in mind any changes in tax law.

- Use the previous year’s federal tax return as a reference for credits and deductions.

- Follow the IRS’s guidelines for making accurate quarterly estimated payments.

- Double-check all mathematical computations and consider using tax software or seeking assistance from a tax professional if uncertain.

Submitting the 1040-ES Printable Form

After completing your printable IRS tax form 1040-ES, submission is the next crucial step. Here is how to proceed:

- Ensure that each Estimated Tax Payment Voucher at the bottom of the form is filled out with your name, address, and social security number.

- Detach the appropriate voucher corresponding to the specific quarter you are paying for.

- Write a check or obtain a money order payable to "United States Treasury" and include your social security number and "2023 Form 1040-ES" in the memo field.

- Mail the voucher along with your payment to the IRS at the address provided in the form instructions for your geographical location.

- If you prefer digital payment methods, consider using the IRS Direct Pay system online or the Electronic Federal Tax Payment System (EFTPS).

Deadlines for IRS Form 1040-ES

The deadline for submitting your printable 2023 1040-ES form falls on a quarterly basis throughout the financial year. For each quarter of 2023, you must ensure that your estimated tax payments are made by:

- April 15: For income received from January 1 through March 31,

- June 15: For income received from April 1 through May 31,

- September 15: For income received from June 1 through August 31,

- January 15 of the following year: For income received from September 1 through December 31.

Note that if any due date falls on a weekend or legal holiday, the deadline is pushed to the next business day. By adhering to these dates, taxpayers can avoid potential penalties for late or missed payments.

To assist you in managing your tax obligations efficiently, our website offers a free downloadable PDF of the printable IRS Form 1040-ES for 2023. It's designed to provide easy access and printing capabilities so that you can quickly begin the process of estimating and paying your taxes well within the prescribed deadlines. Remember, early and accurate submission not only keeps you compliant but also ensures peace of mind as you navigate through the tax season.

Printable 1040-ES Tax Form

Printable 1040-ES Tax Form

1040-ES Fillable Form

1040-ES Fillable Form