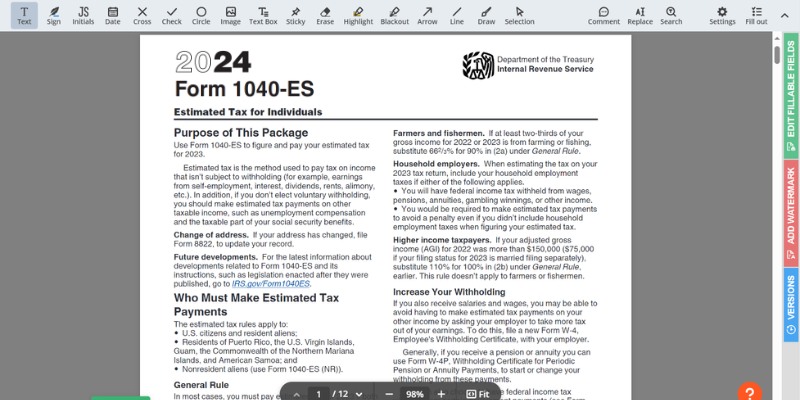

If you're the type that likes to keep Uncle Sam squared away on a quarterly basis rather than annually, the printable IRS 1040-ES form will be your cup of tea. This nifty form is designed for folks who need to tackle estimated tax payments throughout the year, particularly if you're self-employed, a freelancer, or raking in income without withholding taxes, like that of investments or rental properties. It's a forward-looking move that helps keep penalties at bay and aligns with the pay-as-you-earn taxation principle.

Diving into financial forms can be about as fun as watching paint dry, but the 2023 IRS tax form 1040-ES doesn't have to be a head-scratcher. Our resources at 1040es-irsform.com turn a dull task into a breeze with crystal-clear instructions and practical examples to guide you through every box and calculation. Plus, having access to a blank Form 1040-ES that's ready for your numbers makes the whole process smoother than a hot knife through butter. No more hunting down forms or scratching your head over the IRS-speak – our website has got your back.

Obligation to File the 1040-ES Tax Form for 2023

Taxpayers who anticipate owing $1,000 or more when their return is filed should consider the necessity to fill out IRS Form 1040-ES. This form caters to individuals who earn income not subject to withholding taxes, such as earnings from self-employment, interest, dividends, alimony, or rental income. When you have these types of income, it becomes your responsibility to pay the estimated tax to the IRS.

Submission of Form 1040-ES to the IRS is critical for those who earn substantial income outside of traditional employer withholding. This practice helps taxpayers avoid underpayment penalties and ensures that their tax responsibilities are met in a timely fashion. Using this estimated tax method allows people to pay their taxes quarterly, adjusting payments as their financial situation changes throughout the year.

IRS Tax Form 1040-ES Exemptions

There are exemptions for filing this form, and understanding these can prevent unnecessary paperwork. Taxpayers who meet the following criteria may not have to submit this form:

- Those who had no tax liability for the prior year.

- Individuals who were not U.S. citizens or residents for the whole year.

- Taxpayers whose previous tax year covered a 12-month period.

- Residents who anticipate a refund due to ample withholding or credits.

It is pivotal that our understanding of IRS Form 1040-ES for estimated tax is clear and accurate, as it assists in maintaining compliance with the special code and avoiding any future fiscal penalties.

Instructions to Fill Out the Blank 1040-ES Form

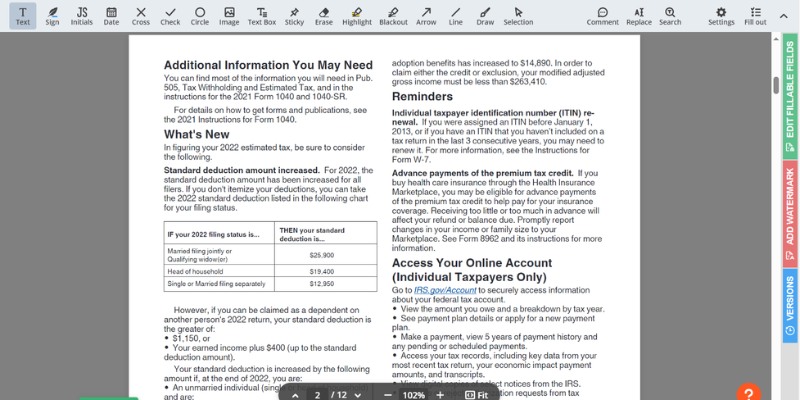

Navigating the complexities of estimated tax payments is imperative for self-employed individuals or anyone expecting to owe taxes. To assist in this endeavor, a concise step-by-step guide for completing the IRS Form 1040-ES for 2023 is provided below, ensuring compliance with the federal regulations:

- Step 1: Access our website and locate the IRS Form 1040-ES printable for 2023 for download. This will be your starting point for preparing your estimated tax payments.

- Step 2: Review the IRS Form 1040-ES for 2023 with instructions on our platform to prepare the requested data. This document contains critical information informing you how to complete the form accurately.

- Step 3: Carefully read through each section of the instructions to understand what information you need, such as your expected adjusted gross income, taxable income, deductions, and credits for the year.

- Step 4: Obtain all necessary financial records that reflect your earnings and expenses. These documents are essential for estimating your tax payments correctly.

- Step 5: When ready to fill out the document, choose IRS Form 1040-ES in PDF format, which is available on our website. This format allows for easy, error-free typing directly into the document.

- Step 6: Enter your personal identification details, including your name, address, and Social Security Number. Make sure this information is accurate to avoid any processing delays.

- Step 7: Calculate your estimated tax liability using the worksheet in the form. It’s important to be precise to prevent underpayment or overpayment of taxes.

Finally, once you have filled out the form and reviewed it for any errors, proceed with printing or submitting it online according to IRS guidelines. Remember to make your payments by the due dates established for each quarter to avoid penalties.

File the 1040 to the IRS on Time

Precision is paramount in taxation, and deadlines are the pillars that uphold the system's integrity. One such deadline pertains to the IRS 1040-ES tax form, a crucial document for taxpayers with earned income not subject to withholding, including self-employment revenue, investment earnings, and rental income. Typically, the form must be submitted quarterly, with the final payment due on January 15th of the following tax year.

The rationale behind this specific due date is rooted in the pay-as-you-go principle. This system aims to collect tax-related contributions throughout the year, reflecting income as it is earned, thereby helping taxpayers avoid substantial year-end tax bills and potential penalties for underpayment. Those unable to file the 1040-ES by the January deadline may send the 4868 copy, which grants an automatic six-month extension. Nonetheless, it's crucial to note that such an extension applies to the filing of the form, not to the payment of taxes due.

Taxpayers are encouraged to file the 1040-ES electronically to streamline the submission process. Leveraging this digital approach ensures efficiency and provides instantaneous confirmation of receipt, a comforting assurance for those navigating through the intricacies of tax compliance.

Federal Tax Form 1040-ES

Federal Tax Form 1040-ES

Printable 1040-ES Form

Printable 1040-ES Form

Form 1040-ES - Instructions

Form 1040-ES - Instructions

Printable 1040-ES Tax Form

Printable 1040-ES Tax Form

1040-ES Fillable Form

1040-ES Fillable Form